The Impact on Public Investment from Drops in Non-Defense Discretionary Spending

by Nick Schwellenbach, 6/14/2013

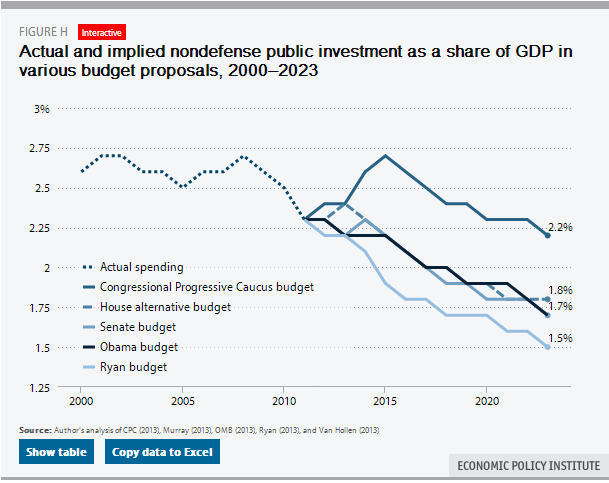

While the damaging impacts of austerity have received increased attention in recent weeks, a new report from the Economic Policy Institute shows that most of the major budget plans being considered in Washington would make things worse.

In an analysis of public investment trends over time, Josh Bivens at the Economics Policy Institute points out that, despite the rhetoric, these investments would take a hit under most of the major budget plans being debated in Washington:

A large majority of physical public investment is financed out of nondefense discretionary spending in the federal budget. Unpublished data provided by the OMB allow us to match up public investment spending with detailed budget function. Between 2010 and 2012, half of spending undertaken in the nondefense discretionary spending portion of the federal budget was allocated for investment. This compares with just about a third of defense spending and trivial amounts (less than 5 percent) of mandatory spending.

Between 2010 and 2012, non-defense discretionary spending accounted for 19.2 percent of all federal spending, yet accounted for 48.1 percent of all public investment. Defense spending accounted for 19.1 percent of federal spending and 40.4 percent of all public investment, while mandatory spending accounted for 55.9 percent of all federal spending and 11.5 percent of public investment. Interest payments accounted for 5.9 percent of federal spending and zero public investment.

The upshot of this is clear: It would be extremely difficult to honor rhetorical commitments to preserve (let alone expand) public investment if non-defense discretionary (NDD) spending is cut significantly. Yet most current budget proposals do indeed cut NDD spending.

The big exception, among the plans he analyses, is the Congressional Progressive Caucus budget plan, which would keep public investments close to historical levels.

Bivens’ whole piece is worthwhile reading for economists and budget wonks, plus there are some great interactive graphics.