Verizon Disputes Our Report Without Backing Up Its Claims

by Scott Klinger, 11/24/2014

Last week, my colleague Sarah Anderson and I published Fleecing Uncle Sam, which examined large corporations that paid their CEOs more than they paid in federal corporate income taxes.

The report generated widespread media coverage and significant corporate backlash. Verizon was one of the corporations that challenged the veracity of our reporting. In an e-mail to Reuters reporter Kevin Drawbaugh, a Verizon representative stated the company paid $422 million in income taxes in 2013. The spokesman added, “We do not provide a breakdown between federal vs. state in that total; however, I am confirming for you that the federal portion of the number is well more than Verizon’s CEO’s compensation.”

Let’s examine Verizon's claims.

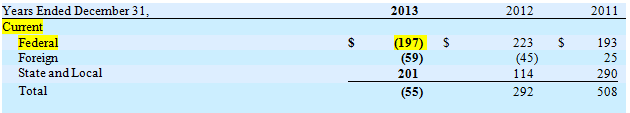

Our report drew data directly from corporate tax disclosures filed regularly with the U.S. Securities and Exchange Commission (SEC). Here is what Verizon reported about the taxes it paid to the SEC and company shareholders in its 2014 Annual Report (Form 10-K):

We use the current federal income taxes line in our report. Most corporations file their annual reports a few months after the end of their fiscal year. Since most companies end their fiscal year at the end of December, most 10-K reports come out in late February or early March. Corporate tax returns are not due until Sept. 15. Thus, the number reported as “current federal taxes” is the company’s best estimate of the U.S. corporate income taxes it expects to pay. In Verizon’s case, that number was -$197 million for 2013.

Contrary to the Verizon representative’s assertion that the company doesn’t break out federal and state taxes, it clearly does in the tax footnote of its annual report shown above. According to the company’s audited financial statements filed with the SEC, it received refunds of $197 million from the federal government, and paid $201 million in state income taxes. Even if you added these together, Verizon still paid its CEO far more ($15.8 million) than it paid in federal and state income taxes ($4 million).

The bigger problem is that companies feel empowered to simply tell journalists information that is not verifiable. The information is easily available and could be shared. Corporations file a tax return similar to that which individuals file. The tax return filed by individuals is the widely known Form 1040. Corporations file Form 1120. Both have a single line called “Total Taxes.” On Form 1120, it is line 31. Corporations could clear up confusion and better make their case by simply publicly disclosing the first page of their Form 1120, which provides basic summary information, including the line that shows what taxes they actually owed.

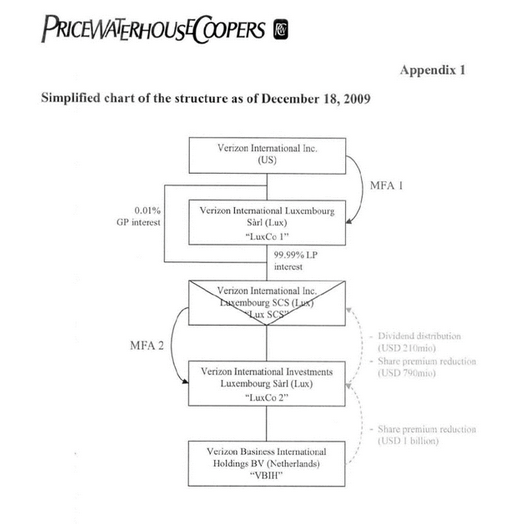

Earlier this month, Verizon was caught in another tax disclosure controversy. The International Consortium of Investigative Journalists (ICIJ) released more than 500 private tax rulings (involving nearly 340 companies) secretly negotiated with the government of Luxembourg. The leaked documents revealed the work of PricewaterhouseCoopers to help corporate clients avoid paying income taxes. One of the companies the accounting giant helped was Verizon. In a document dated March 10, 2010, PricewaterhouseCoopers outlines a complex accounting arrangement (see a diagram of the relationships below) involving three Verizon Luxembourg subsidiaries used to shelter at least $400 million from taxes in the United States. Though the SEC requires companies to disclose significant subsidiaries to shareholders each year, Verizon made no mention of any Luxembourg subsidiaries in its 2008, 2009, or 2010 annual reports. In fact, it listed no foreign subsidiaries at all.

Source: International Consortium of Investigative Journalists: Luxembourg Leaks Database

Actions such as those undertaken by Verizon in Luxembourg appear to have no clear economic purpose beyond allowing the company to avoid paying taxes. The arrangements are legal in Luxembourg, but it is less clear whether the IRS will view them that way now that these documents have come to light. If the IRS determines the arrangements that Verizon undertook do not have sufficient economic purpose, the company could be on the hook for more than $100 million of U.S. income taxes on the transaction.

Corporations like Verizon are public companies not because they are publicly traded, but because so much of their success comes from public subsidies, including government contracts and tax breaks. If you are a U.S. taxpayer, you are paying to help Verizon build its cell towers, and you help subsidize the inflated pay of its CEO and other executives (every three dollars paid to a CEO reduces a company’s taxes by a dollar). As taxpayers, we invest in the success of American corporations, and as investors, we need basic information about our investments. One of those pieces of information is precisely how much corporations are investing in the common good through the taxes they pay.